The Love & Money Series

Helping you plan with care for the people and moments that matter

Key takeaways

- Understand your options: Couples may opt to use joint, individual, or a mix of both joint and individual bank accounts, depending on their needs and approaches to money.

- Using joint accounts may offer both spouses visibility over those funds, shared fiscal responsibility, and an easier path forward if one of you dies. However, some couples may conflict over how the account is used or even abused.

- Using individual accounts may offer spouses more individual freedom in managing money, which can be important for those with separate expenses. But it’s possible you and your partner might lack opportunities to make a more cohesive financial strategy.

- What is best for your relationship? You and your partner should discuss your preferences and come to an answer together, Wells Fargo specialists said.

In any relationship, the question may inevitably come up: Should we keep our own separate bank accounts? Should we open a joint account? Should we have both?

How you and your spouse (or future spouse) or partner manage your money can mean much more than you might think. Wells Fargo specialists say your daily-use bank account(s) can influence how you two approach money, make financial decisions, and even plan for your future.

“The decision reflects how you’re thinking about earning, saving, and giving. It reflects a philosophy of life: ‘What does it mean to earn? Whose earnings are those? Who am I spending for? Is it a personal or shared project?,’” said Mariana Martinez, a senior family dynamics consultant with Wells Fargo Wealth & Investment Management.

These are important questions for every couple to answer as they plan for a financially happy and healthy life together. What that answer is will inevitably be different for everyone, but there are potential advantages and disadvantages you and your partner should consider.

Joint vs. individual accounts: What’s the difference?

What is a joint account?

A joint account is a checking or savings account with two accountholders with the same primary authority. Even though there are two people responsible for the account, one person can make transactions or changes to the account without the other’s permission.

What is an individual account?

An individual account is the same checking or savings bank account, but there’s only one primary accountholder who’s able to make transactions and access the account.

Typically, primary account holders of either joint or individual accounts can give another person view-only access, such as a parent who’s able to monitor their child’s account activity.

Pros: Joint bank accounts

Shared responsibility

When two people decide to live their life together, they explicitly or tacitly agree to take on expenses together. Paying for these costs using a joint account may naturally follow logically or philosophically for many couples.

“A joint account represents the desire to have a combined journey,” Martinez said.

Simply put, this joint account creates a shared place for you and your spouse to put money and use it. When covering fixed expenses like rent or a mortgage, utilities, or insurance, you both can have peace of mind knowing these shared bills are covered because you’re working on them together, in addition to the visibility to see transactions are made. The advantage of a joint account is that both of you may be actively engaged or at least familiar with managing the account.

Joint visibility

The clearest benefit of a couple managing their money with a joint account is that both people can see that money and how it’s being spent. This could lead to both members of the relationship having a more holistic view of their finances. That way, you can check if you’re on track with your budget or if you’re both working toward your goals.

Joint visibility into you and your partner’s accounts may make it easier to create a more cohesive financial plan. The opposite may be true if you and your partner don’t know how much money the other has in their accounts or how they’re being managed, said Travis Taylor, a financial advisor and CERTIFIED FINANCIAL PLANNER® professional with Wells Fargo Advisors.

This visibility also means there could be two sets of eyes monitoring recent account activity for unexpected or dubious transactions, fraud, or scams.

It could be easier to pass on money

A joint account makes it easier for a spouse to access that money if the other spouse dies compared with individual accounts, Taylor said.

When the worst happens, anything in that account will pass to the surviving accountholder. If it were an individual account, that spouse may need to enter a probate process to get those funds.

“That’s a pro if you know that money needs to go to your spouse if something were to happen to you,” Taylor said. “It could be considered a con, though, if one spouse has a different opinion of where that money should go after death.”

If you and your spouse feel differently about where those joint account funds should go when you pass on, opening a trust is one option to ensure your wishes are followed.

Cons: Joint bank accounts

Assumed roles can arise

Naturally, people may carry assumptions or expectations of all sorts when it comes to money, including who carries the most responsibility of managing the couple’s joint bank account. Left unspoken, these attitudes can lead couples to not fulfilling both members’ financial needs.

“Pay attention to how those inherited views are handled and how they’re informing what the couple is doing,” Martinez said.

For example, if one spouse is the household’s primary earner, makes all major financial transactions using a joint account, and dies unexpectedly, that may leave the other spouse less prepared to manage money alone because they haven’t had to handle the account. However, this is only a disadvantage if you or your partner aren’t familiar with how to manage the account.

Trust can be broken

Sharing a financial account relies on trust between partners to earn, save, and spend money together with some level of shared expectations. However, that bond can be broken if a spouse breaks those rules or expectations, such as by overspending, withdrawing funds inappropriately, or failing to cover bills.

“If there is ever a breach of trust in the relationship, that joint authority can be problematic,” Taylor said.

If conflict arises, you and your spouse may be able to rebuild that bond by talking honestly about what happened, how it overstepped a boundary or made you feel, and what can be done to regain trust moving forward.

Trickier to decouple if your relationship ends

While joint accounts can help couples manage their money over the course of their relationship, they will likely need to be closed if you and your spouse decide to end your relationship or marriage.

If you and your spouse get divorced, your joint account will most likely be considered marital property and be split according to your state’s laws or what’s dictated in your divorce proceedings, assuming both you and your partner contributed to it. If you’re in this position, work with your attorney and your bank to manage the account accordingly throughout the divorce process.

A prenuptial agreement can help you and a future spouse make your accounts known to the other partner and discuss how you’d like them handled in the event your marriage ends. For married couples, a postnuptial agreement can establish your joint plan of how to handle your accounts in the case of death or divorce, removing the uncertainty from a difficult time.

“The account type, in my mind, does not dictate a happy retirement for a married couple. What more likely dictates a happy retirement are two people who … set a plan early in life and follow up on that plan until they retire.”

Pros: Individual bank accounts

Both you and your partner must manage money

If you and your partner decide to keep the individual bank accounts you entered your relationship or marriage with, you’ll likely manage them as you did.

By maintaining some individual responsibility with money, you may both preserve or improve your financial literacy skills and ultimately will serve your relationship better if each of you have an individual account.

“Individual accounts help keep both people financially responsible,” Martinez said. “You want both people to be competent in financial management.”

Allows for different money habits or approaches

If you and your spouse keep separate bank accounts, you may more easily move, spend, and save your money how you’d like because you won’t need to factor in another person.

“That gives people room and, in my experience, it’s one less thing where friction can come up,” Martinez said.

For example, if you’re more frugal and your partner is less so, you could agree to use your money as you want, beyond meeting any shared financial goals or budget. For another couple, one spouse may have a stable income and opt to cover fixed expenses while the other person could use their varied income to pay down debt or cover rainy day purchases.

Spouses may have separate expenses

Both people in a marriage may prefer to handle expenses that only pertain to them. In some relationships, it might not be appropriate for these payments to come from a joint account. This may be particularly important for spouses who must pay alimony, child support, or other payments stipulated in a divorce, for example.

If you or your spouse have been married and divorced previously, the idea of combining your finances into a joint account might be tough, especially if decoupling your finances with a previous partner was emotionally, financially, or logistically difficult. If that’s the case, having separate individual accounts may be a good alternative.

“This [question] comes up pretty often if you have two people who’ve had difficult divorces and they’re bringing their money together,” Taylor said.

Cons: Individual bank accounts

Potential lack of cohesion with your finances

Without a joint account, couples may not have organic opportunities to discuss and agree on financial goals and how to budget their money. These are two building blocks to a cohesive strategy for a financially healthy marriage and successful long-term planning.

“Going from happily married to happily retired is hard. To me, it all starts with setting a goal for what you want your retirement to look like together and how you accomplish that,” Taylor said.

For some, however, that may be easier with a joint account that allows spouses to see each other’s spending and savings habits with those funds, Taylor said.

Power dynamics can emerge

When spouses have separate accounts, their financial differences could be exacerbated, Martinez said.

For example, if one spouse earns more and has more funds to spend on hobbies, clothes, or other discretionary purchases, it might lead the other person to develop negative feelings. For another couple, uneven incomes or access to money might lead to feelings of inequality in the relationship.

“Separate accounts can reduce resentment, but they can also invite competition. That might not be the best approach to building a life together,” Martinez said. “[Your account structure] activates the power dynamics that more often than not money brings to the table.”

There’s no default transparency

The same freedom that can empower couples to manage money how they want may also lead to confusion, a lack of accountability, or even financial dishonesty.

Financial secrets aren’t uncommon. In fact, 88% of Americans surveyed in the 2025 Wells Fargo Money Study (PDF) said everyone should have a secret reserve of money for themselves “just in case.” How they keep that secret reserve — in a bank account, investment, an asset or valuable, or another method — may look different for everyone.

“Having an individual account means that only spouse A can see spouse A’s account. Spouse B? Not so much,” Taylor said. “How can you hold each other accountable to have a happy retirement if you’re not working together?”

When to decide if you should have joint or separate accounts

There’s no wrong or right time for couples to make a change when it comes to their bank accounts. The best decision is one made jointly and with intention.

You and your spouse shouldn’t feel pressure to create a joint account right when you live together or get married if it doesn’t come up organically. Suddenly changing how you manage money without prior planning, especially as you navigate big life changes, can be a “recipe for disaster,” said Sylvia Guinan, a financial advisor with Wells Fargo Advisors.

Instead, try “baby steps,” like paying a bill through a joint account and adding other expenses over time, Guinan added. A potential entry point for newer couples might be opening a joint account to cover some wedding expenses, Martinez said.

“What often makes sense is to have a joint account for joint bills — the house, electric — and maybe for your vacations, but I think it’s nice for everybody to keep a bit of their independence,” Guinan said.

Don’t let the timing of your decision keep you and your spouse from making it at all. Being intentional with money is an aspiration for many: Nearly everyone (94%) surveyed in the 2025 Wells Fargo Money Study said they want to make money choices that align their with values.

“The account type, in my mind, does not dictate a happy retirement for a married couple. What more likely dictates a happy retirement are two people who … set a plan early in life and follow up on that plan until they retire,” Taylor said.

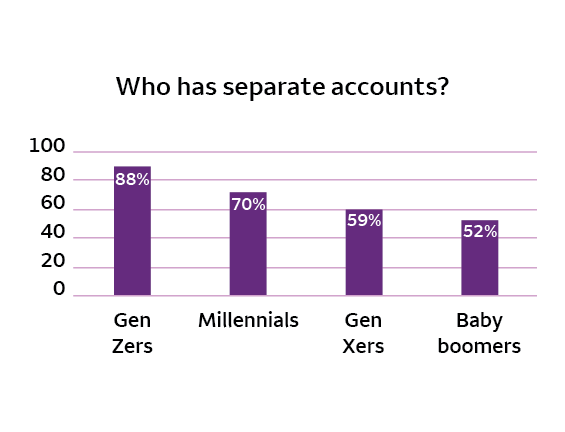

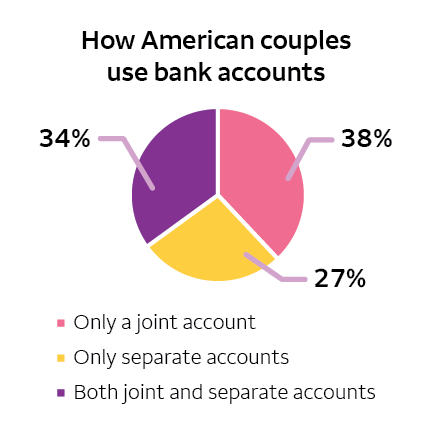

What are other couples doing with their bank accounts?

Source: YouGov Plc survey of 2,217 American adults conducted Dec. 9–11, 2024 on behalf of Bankrate

Curious how other people use joint or separate bank accounts? One survey suggests relying on joint accounts is the most popular approach, but a mix of both joint and separate bank accounts was also popular.

Source: YouGov Plc survey of 2,217 American adults conducted Dec. 9–11, 2024 on behalf of Bankrate

Most Americans (62%) polled in a 2024 Bankrate survey said they keep at least some money separated in individual accounts, but joint accounts are quite common, too. Nearly three in four people (73%) in the survey reported using a joint account for all or part of how they manage their money.

FAQ

While not all accounts will have the same terms and conditions, yes, you can typically add a spouse or partner to an existing checking or savings account. For Wells Fargo accounts, visit a Wells Fargo branch to start the process of adding your spouse or partner to your account. You can make an appointment online or through the Wells Fargo Mobile App.

No, you do not need to be married to open a joint bank account with a spouse, partner, boyfriend, or girlfriend.

Get professional financial advice

No matter what stage of life you and your partner are in, a Wells Fargo Advisors financial advisor can help you work toward your investment goals.